Crypto loan platform overview

- Oct 1, 2023

- 5 min read

Celsius Network is a Blockchain-based marketplace platform that focuses on consumer lending, fintech, and financial services. Well established player in the crypto space with over 1.5 million users.

Summary

The problem we were addressing involves users who own multiple loans and frequently miss and forget to pay their interest payments. Our goal is to find an efficient and responsive way to inform these users about their loan statuses.

My input

As a Senior Product Designer for Celsius, I led the creation and strategy behind the loan overview, a vital feature at the core of our platform. Working with a diverse team including six Product Managers, mobile and web developers, a development architect, a marketing manager, and stakeholders, we crafted a seamless user experience (UX) and visually appealing user interface (UI). From research to implementation, I ensured alignment with user expectations and business goals throughout the design journey.

Research

During our investigative phase, we gathered extensive insights about our potential users and their interactions with our platform. Our objective was to identify pain points within the process of loan origination and comprehend their origins. Through this exploration, we uncovered challenges tied to user regulatory requirements based on their residing country. These users necessitate a distinct strategy to address their concerns effectively. Moreover, our research highlighted that the existing loan feature doesn't fully align with user needs. To rectify this, we intend to pivot towards a user-centric approach. Users have encountered difficulties in comprehending loan issues and the steps required for resolution.

What do we have today

Confusion around fees they need to pay: Users seek clarity on why the fees they're required to pay vary each time, often perceiving it as an error and turning to the community or Support for answers.

Comprehension around loans statuses is low: Users struggle to understand the various loan statuses and what they signify.

Users take loans irresponsibly: Users take out crypto loans but often lack a full understanding of how they operate, including when and how they should repay interest.

Threat to their trading security: Users rely on their loans to purchase other crypto assets. However, failing to pay loan interest on time can lead to additional fees and disrupt their normal trading security.

Design principles

By focusing on user-centric approaches, we ensured that the design was tailored specifically to users' needs, behaviors, and preferences. Following these principles provided a consistent framework for our decision-making process, promoting clarity and effective communication within the team. These guidelines also acted as a foundation for creative problem-solving, encouraging innovative solutions while maintaining usability. By adhering to established design principles, we streamlined our design process, saving time and effort, ultimately leading to a user interface that was not only visually appealing but also intuitive and trustworthy. This approach resulted in a successful product that delighted users and fostered a positive brand relationship.

Key Solution Elements

Consistency: Loan screens with similar information and actions should maintain consistency to instill confidence in users' decision-making processes.

Optimization: Each loan status offers a restricted set of actions that users can take.

Health Indication: Display to the user the health of their loan and provide guidance on the necessary steps they should take.

Education: Educate our users using plain language, clearly explaining the critical aspects of their loans.

Information architecture

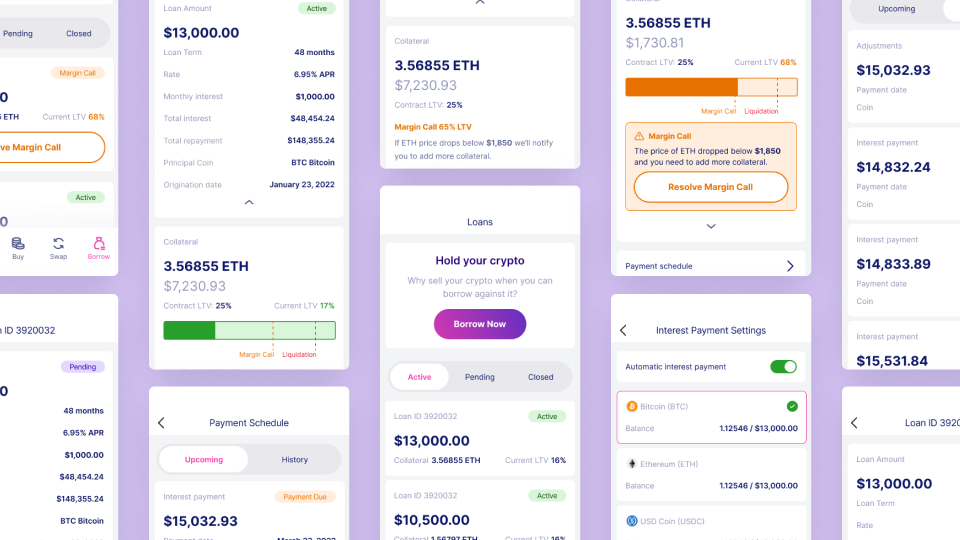

With users as the main focus, I began organizing the key screens of the app. My aim was to ensure a seamless and organized user experience that directly caters to their needs. At the heart of this strategy lies the Loan Overview screen, functioning as the app's central hub. This screen functions as a dashboard, presenting users with their statuses, available loans, and options to initiate new loans. Within each showcased loan, users can access information, documents, and a range of actions they can take. I've strategically mapped out which screens and structures can be reused to facilitate effortless navigation for users.

Suggestion

To assist lenders in their learning process, we've chosen to incorporate the loan origination flow into our scope, as it plays a substantial role in our users' lending journey. Our goal is to offer lenders a complete grasp of the lending process, ensuring they feel secure and confident in their actions.

Pros It encompasses the entire user lending journey, providing a seamless learning experience and users are well-prepared.

Cons This addition will increase the workload for our team, and we may need to extend our deadlines.

User testing

To align with our design principles and ensure real user validation, we conducted digital usability sessions with members of our community. These sessions involved individual interviews and hands-on tasks within the app. By observing user reactions and documenting their experiences, we gained valuable insights. Analyzing their interactions allowed us to draw meaningful conclusions, shaping our design decisions based on authentic user responses. This user-centered approach significantly contributed to refining our product and delivering an enhanced user experience.

Rediscovering “Health”

During user testing sessions, we observed that lenders often became confused by the loan status colors, leading to incorrect assessments of their loan's health. As a response, we decided to spread out all of Celsius's distinct status labels and create clear distinctions between statuses and health indicators.

Credit education program

With the invaluable support of our marketing partners, we successfully introduced a Credit Education Program. Its primary goal is to provide our lenders with comprehensive knowledge about how loans function, including the specifics of when and how they should repay interest.

Health indication

Lenders should have the ability to easily check the status of their loans and take necessary actions whenever required. This functionality proves especially valuable in situations where their loans approach Margin Call or Liquidation risk, enabling them to act promptly and prevent any potential escalation.

Flexible payment

Beyond just payment scheduling, our platform offers the convenience of automatic interest payments, where a lender's monthly interest dues can be seamlessly deducted from their account. Moreover, users have the flexibility to switch their interest payment coin at any time, ensuring a tailored experience that suits their preferences.

Web platform squad

In addition to integrating the solution into the Celsius mobile app, another part of my task involved replicating the same solution in the web app. Throughout the project, I found it crucial to frequently pause and carefully consider how to ensure consistent implementation of key components across both platforms.

Design Handoff

I collaborated closely with both web and mobile engineers to validate the design and copy implementation. In addition to our daily meetings, we conducted weekly demos and occasionally sit side by side to cross-check the implementation against the design intent.

Learning

One of the key lessons I've gained from this project is understanding the distinction between health and progress statuses, learning how they can coexist on the same platform without confusing users. Due to time constraints, I realize the importance of dedicating more time to AB testing different solution suggestions. Additionally, I acknowledge the need to translate the solution to web versions with higher accuracy, specifically tailored to web users' needs.

Comments